Recently, Gree Electric Appliances (000651.SZ) quietly increased its stake in Highly-owned shares (600619.SH) to 5% of its licensing lines and received extensive attention and was inquired by the regulatory authorities. From the risk of Baoneng placards to the licensing of Highly, Dong Mingzhu’s rapid change in character is embarrassing.

The age of retirement has reached, the acquisition of Yinlong has been blocked, and the performance has been surpassed by the United States. What does Dong Mingzhu hold to promote the company's shares?

From witnesses, medical examinations to people

When the struggle for Vanke shares intensified in December 2015, Tiger Sniff had alerted Dong Mingzhu to the possibility of “a barbarian attacking a backyardâ€.

At that time, Dong Mingzhu was really asked by the media “if it was a strategy for dealing with placards.†She strongly replied “any compromise, any regression, or any neglect is not allowed here.â€

One year later, Qianhai Life purchased Gree Electric Appliances in the secondary market. Dong Mingzhu’s vigilance was extremely high. Prior to November 28, 2016, Hais Life had less than 5% of its licensed lines, and Gree Electric issued an announcement that “the proportion of Qianhai Life’s holdings rose to 4.13%.†The "barbarians" were just close. Miss Dong screamed with high decibels.

Dong Mingzhu also warned in high-profile that "Do not destroy China's manufacturing and become a sinner in society." Finally, under the increasingly severe regulatory situation and Dong Mingzhu’s high morale, Qianhai Life seriously promised that “In the future, Gree will no longer increase its holdings, and will withdraw from the market according to market conditions and investment strategiesâ€.

On September 21, 2017, Gree Electric announced that it would hold "Haili shares (600619.SH) to 5%". The announcement shows that since August 29, Haili shares resumed trading. Gree Electric Appliances has purchased 43.31156 million shares in the secondary market for 16 consecutive trading days.

On September 23rd, Gree Electric Appliance Co., Ltd. made two promises in replying to regulatory inquiries: it will not reduce its holdings within the next 12 months; it will actively participate in the share transfer plan of Haili shareholders. Gree also claims that there is no plan to explicitly increase or obtain control of Haili shares. #Not sure nor exclude

Haili Securities suspended trading on September 21, apparently not wanting Gree to continue to increase its holdings and prevent price volatility. It is expected that trading will be resumed on September 25, but it will not be able to catch up with the changes. If things do not "get settled," Haili will find the reason for the suspension.

Gree acknowledged that after Haili announced the "Announcement of Termination of Transfer of the Company's Shares" on August 23, 2017, it did not have any contact with the controlling shareholder of Haili Group."

According to Wang Shi’s explanation, “I’m not talking to you. I don’t care what you say. I’m going to control you. This is malicious.†The previous year witnessed Wang Shi’s being “malicious.†He was almost “malicious†last year and Dong Mingzhu would be “malicious†this year. "Others.

I don't want people to add me, too. I also want no additional people. Child. Give it also. Feier is also. # is not her realm #

Down-hearted? That is someone else!

Dong Mingzhu galloped into new energy vehicles and moved to compressors. Her backyard was always Gree, just as Jia Yueting’s backyard was LeTV.

In the successive years of battles between the United States and Gree, Fang Hongbo became more and more brave and later came to the fore. Dong Mingzhu seemed to have no heart.

1) Scale out of the team

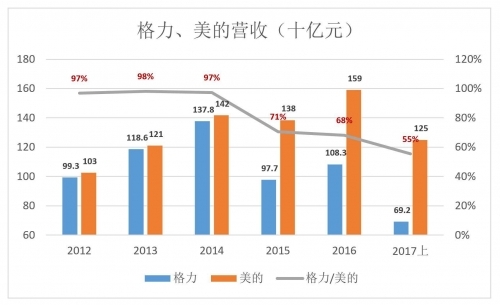

In 2012, Fang Hongbo and Dong Mingzhu became "traders" of the United States and Gree, respectively. In that year, the two revenues were 103 billion and 99.3 billion respectively, and Gree was 97% of the United States. In 2015, Gree fell behind and the revenue was only 71% of the United States. In the first half of 2017, it fell to 55%.

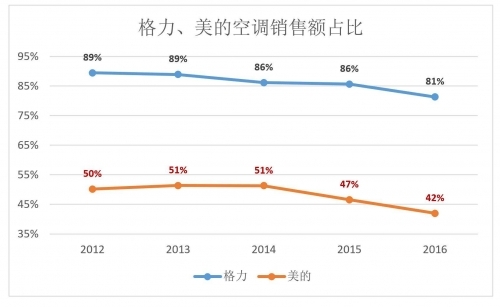

From the perspective of product structure, Gree is highly dependent on air conditioning. In 2016, 81% of Gree's revenue came from air-conditioner sales, compared with only 42% in the United States.

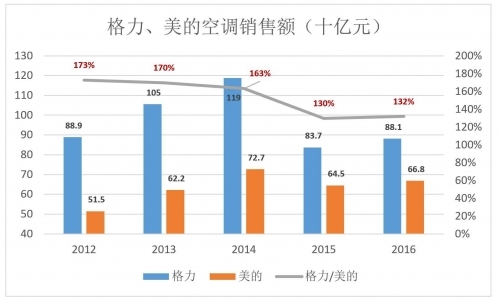

In terms of air conditioning alone, Gree still has a considerable advantage. However, since 2014, Gree Air Conditioner sales began to fall. In 2016, it was only 74.2% in 2014. In the same period, air-conditioning sales in the United States also fell, but the rate was far less than Gree.

2) Difficulties in air conditioning

Gree Air Conditioning not only has sales more than 30% higher than the United States, but its gross profit margin has always been one of the highest.

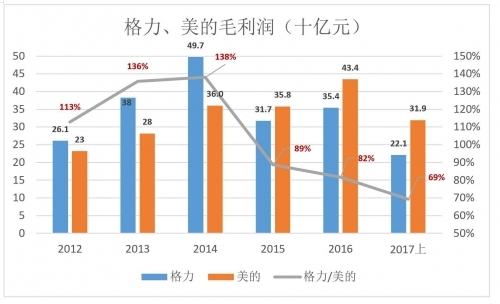

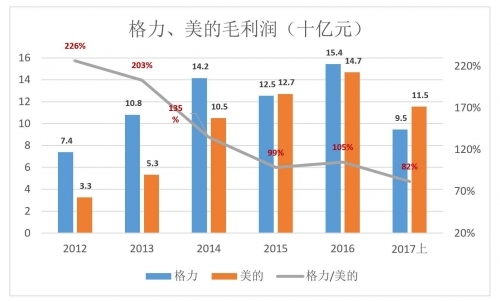

Due to the high gross profit margin of the air-conditioning business, when the revenue gap is small, the overall gross profit margin of Gree Electric Appliances far exceeds that of the United States. In 2014, Gree's gross profit reached a record high of 49.73 billion, equivalent to 138% of the United States. With the rapid decline in revenue, Gree's gross profit has finally fallen below 70% of the United States. In the first half of 2017, Gree's gross profit was $9.8 billion less than that of the United States, equivalent to a monthly profit of 1.64 billion.

Finally look at the net profit. In 2012, Gree's net profit reached 7.4 billion yuan, which is a 126% increase compared with the United States. In 2015 and 2016, the net profits of the two companies were “stickyâ€. In the first half of 2017, the sudden development of the United States, Gree net profit fell to 82% of the United States.

Gree’s profitability is still highly dependent on the air-conditioning business, and Midea’s air-conditioning, ice-washing, and small household appliance businesses have blossomed. Gree gradually became tired.

3) Mystery mobility

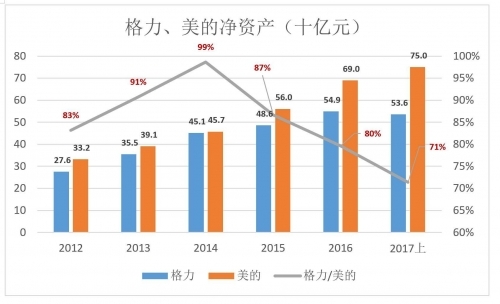

The net assets of the United States are always higher than Gree. In 2014, it was nearly equalized, and its lead advantage has become increasingly evident. By June 30, 2017, U.S. net assets were approximately 75 billion U.S. dollars, Gree was equivalent to 71% of the U.S. dollar, and the gap was 21.4 billion U.S. dollars.

Due to the higher debt ratio, Gree’s total assets were higher than those of the United States for the long term, and it was not exceeded by the US until 2017. As of June 30, 2017, the net assets of the United States reached 231 billion, which is 26.44 billion more than that of Gree.

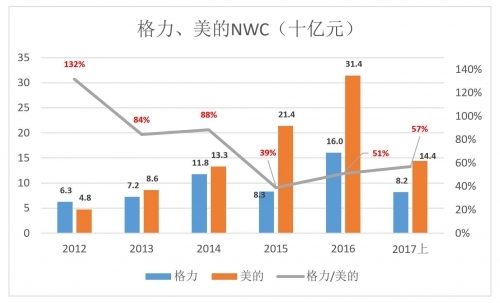

Net working capital NWC (current assets minus current liabilities) is Graham's most concerned indicator. It can be said that NWC is the cornerstone of his lifelong practice and theory.

Since the beginning of 2013, Gree NWC has been significantly lower than that of the United States. As of the end of June 2017, Gree and Meilian NWC were 82 billion and 144.1 billion respectively, and Gree was 57% of the United States.

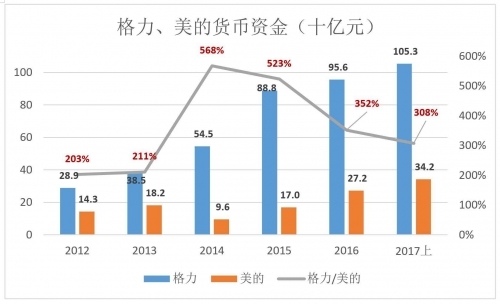

Somewhat surprisingly, Gree's net working capital is far lower than that of the United States, and it holds far more monetary funds than the United States. As of the end of June 2017, Gree's currency funds reached 105.3 billion yuan, which is 308% of the United States.

In 2016, the operating costs of Gree and Midea were respectively 72.9 billion and 115.6 billion. At the end of June 2017, Gree and Midea had book funds of 105.3 billion and 34.2 billion respectively. Relatively beautiful, Gree holds a lot of cash.

In 1990, 36-year-old Dong Mingzhu moved southwards to Zhuhai, and the martial arts in the air-conditioning industry for 27 years is obvious to all. However, in the years of Zhu Jianghong’s retirement and Dong Mingzhu’s solo flight, Gree’s performance has been high, and many important indicators have been crushed by opponents and they have remained marginal.

Most people who change to other festoons will "have a white hair and return to their homes, and the poetry of wine will grow." Dong Mingzhu is not the case, she also wants to do things!

Is there 8 months to serve? Is it ready to hand over power?

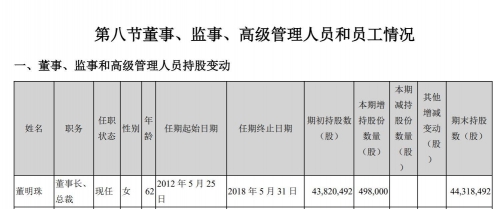

Gree Electric Appliances 2016 annual report shows that Dong Mingzhu's tenure ends on May 31, 2018, leaving only 8 months left! According to the state-owned enterprise leading cadre retirement system, when the 64-year-old Dong Mingzhu will hand over power.

As early as October 2016, the SASAC of Zhuhai City has removed the chairman of Dong Ming Zhu Gree Group. The successor Zhou Lewei is a young cadre trained by the city government and is obviously the first person to succeed Dong Mingzhu. # Zhou Lewei must remember Zhou Shaoqiang's lesson #

With Zhu Jianghong and Dong Mingzhu having retired and retiring from their posts, the grudges of Zhuhai SASAC and Gree Electric Appliances Co., Ltd. can finally be closed for nearly two decades. For details, see "Dong Mingzhu's Front Door Rejected "Wolf" 22 Years."

There is a "59-year-old phenomenon" in the officialdom (before retiring), professional managers may not have a "64-year-old phenomenon."

Dong Mingzhu vigorously promoted Gree’s shift toward new energy vehicles, and he intended to wholly acquire Yinlong, which must be associated with her retirement plan.

In September 2016, Gree Electric officially disclosed its plan to issue 100% equity in Zhuhai Yinlong to issue shares and raise matching funds. Yinlong’s consideration is RMB 13 billion, and the target for the 9.7 billion matching funds includes Dong Mingzhu (intended to invest RMB 940 million).

However, the acquisition failed to be approved in the shareholders meeting due to the acquisition of matching funds. The acquisition failed in November 2016.

In December 2016, Dong Mingzhu joined Wanda, Jingdong, and CIMC to invest RMB 3 billion (22.388% equity) in Zhuhai Yinlong. Dong Mingzhu’s personal investment was about 1 billion yuan, and gained 7.46% of the equity. By April 2017, Dong Mingzhu’s shareholding ratio has risen to 17.46%, making it the second largest shareholder.

In February 2017, Gree’s Board of Directors approved the “Cooperation Agreement†with Zhuhai Yinlong, according to which the agreement “takes one year as a cycle, and the two sides' mutual preferential purchase and total amount does not exceed RMB 20 billion.â€

Gree and Highly are the world's largest refrigerator plants and compressor manufacturers, respectively, and it can be explained from the perspective of vertical integration. However, industrial synergy must participate in stocks/controls, not to mention malicious cards?

The idea of ​​Dong Mingzhu may be like this (if any similarity is purely coincidental):

The first step, under the banner of industrial cooperation, won the Heili (or Xiali) with Gree's money;

The second step is to send a department to control the company’s board of directors to ensure that retirement can still exert influence;

The third step is to issue shares to acquire Yinlong by using Haili shares as a platform to achieve backdoor listing.

Speakers are one of the most common output devices used with computer systems. Some speakers are designed to work specifically with computers, while others can be hooked up to any type of sound system. Regardless of their design, the purpose of speakers is to produce audio output that can be heard by the listener.

Speakers are transducers that convert electromagnetic waves into sound waves. The speakers receive audio input from a device such as a computer or an audio receiver. This input may be either in analog or digital form. Analog speakers simply amplify the analog electromagnetic waves into sound waves. Since sound waves are produced in analog form, digital speakers must first convert the digital input to an analog signal, then generate the sound waves.

The sound produced by speakers is defined by frequency and amplitude. The frequency determines how high or low the pitch of the sound is. For example, a soprano singer's voice produces high frequency sound waves, while a bass guitar or kick drum generates sounds in the low frequency range. A speaker system's ability to accurately reproduce sound frequencies is a good indicator of how clear the audio will be. Many speakers include multiple speaker cones for different frequency ranges, which helps produce more accurate sounds for each range. Two-way speakers typically have a tweeter and a mid-range speaker, while three-way speakers have a tweeter, mid-range speaker, and subwoofer.

Speaker System,Magnet Speaker Acoustic,Moving Coil Loudspeaker,Metal Frame Mylar Speaker

Jiangsu Huawha Electronices Co.,Ltd , https://www.hnbuzzer.com