The transformer is a device that uses the principle of electromagnetic induction to change the AC voltage. The main components are the primary coil, the secondary coil, and the iron core (magnetic core). The main functions are: voltage conversion, current conversion, impedance transformation, isolation, voltage regulation (magnetic saturation transformer) and so on.

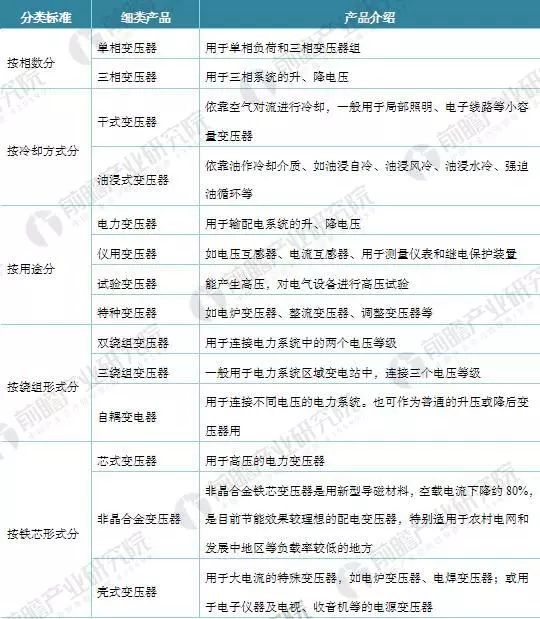

According to different classification standards, transformers are divided into different product types. Currently, there are mainly five classification standards. According to the number of phases, the fine products can be divided into single-phase transformers and three-phase transformers; according to the cooling method, the fine products can be divided into dry-type transformers and oil-immersed transformers; according to the use, the fine products can be divided into electric power. Transformers, instrument transformers, test transformers, special transformers; according to the form of windings, fine products can be divided into two winding transformers, three winding transformers, autotransformers. According to the core form, the fine products can be divided into core transformers, amorphous alloy transformers and shell transformers. See the table below for details.

Figure 1: Transformer product classification category

Source: Prospective Industry Research Institute

Increase in the number of patent applications related to transformer technology, and promote the advancement of regional industries

In recent years, the country has invested a large amount of infrastructure, and the power industry has also developed rapidly. The transformer industry has expanded rapidly and its production capacity has increased substantially. During the “Thirteenth Five-Year Plan†period, the state adjusted its energy structure and built a smart grid and other strategic plans, which brought new development opportunities to the transformer industry and raised higher technical challenges.

According to the data from the Prospective Industry Research Institute's "2018-2023 China's Transformer Manufacturing Industry Market Demand Forecast and Investment Strategic Planning Analysis Report", the number of patent disclosures of China's transformer technology has also shown a steady upward trend in 2009-2017. The number of 3,362 in the year increased to 15,375 in 2017, with a compound annual growth rate of 20.93%.

Chart 2: 2009-2017 transformer technology related patent disclosure quantity change chart (unit: one)

Source: Prospective Industry Research Institute

China's transformer patent technology applicants look at the State Grid Corporation applied for the most patents, reaching 7396, accounting for 6.04% of the total; Baoding Tianwei Group Co., Ltd. ranked second, 790; China Electric Power Research Institute applied for 605, Ranked third.

Figure 3: Composition of patent applicants related to transformer technology as of the end of 2017 (unit: unit, %)

Source: Prospective Industry Research Institute

In terms of the distribution of patent technology applications for transformer technology in China, H01F has the largest distribution, with 32,856 patented technologies, accounting for 25.88%; followed by H02M and H02J, with 13,603 and 9,580 respectively, accounting for 10.72% and 7.55% respectively. .

Chart 4: The proportion of China's transformer-related patent technology as of the end of 2017 (unit: unit, %)

Source: Prospective Industry Research Institute

The increase in the number of transformer technology patents has promoted the development of the industry. Enterprises in all regions make full use of innovative technologies to continuously improve production processes and improve production efficiency. At present, most of the transformer manufacturers in the country are concentrated in East China. According to the statistics of the Prospective Industry Research Institute, the transformer manufacturing enterprises in East China accounted for 49.10% of the total number of enterprises in the country in 2016, among which the largest number of enterprises in the region is Jiangsu Province, with 340; from the perspective of sales revenue, East China Sales revenue has a large advantage in all regions. In 2016, the proportion of sales revenue was 50.04%; followed by South China, which accounted for 13.42%.

Figure 5: The proportion of enterprises in various regions of China's transformer manufacturing industry in 2016 (unit: %)

Source: Prospective Industry Research Institute

Figure 6: Proportion of sales revenue in various regions of China's transformer manufacturing industry in 2016 (unit: %)

Source: Prospective Industry Research Institute

Transformer manufacturing industry development prospects

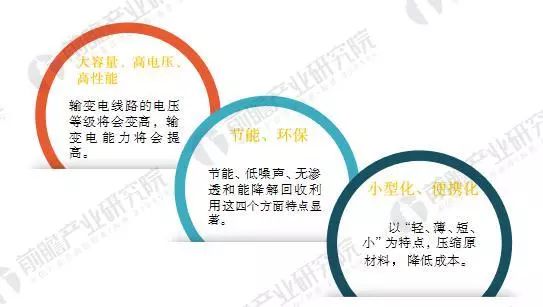

With the rapid development of China's economy and the increasing demand for electricity, the main equipment transformers in power transmission and transformation systems have also been greatly developed. In order to adapt and meet the market demand, many transformer manufacturers have continuously improved the product structure, improved product performance, introduced advanced production technology and equipment from abroad, and strengthened the exploration of new technology and new materials. The development has the following three trends:

Figure 7: Trends in the transformer manufacturing industry

Source: Prospective Industry Research Institute

At present, the smart grid has entered an important stage of comprehensive construction, and the intelligent construction of urban and rural distribution networks will be fully opened. The smart grid and smart complete sets of equipment, intelligent power distribution and control systems will usher in the golden development period. This undoubtedly provides a good room for growth in the transformer manufacturing industry.

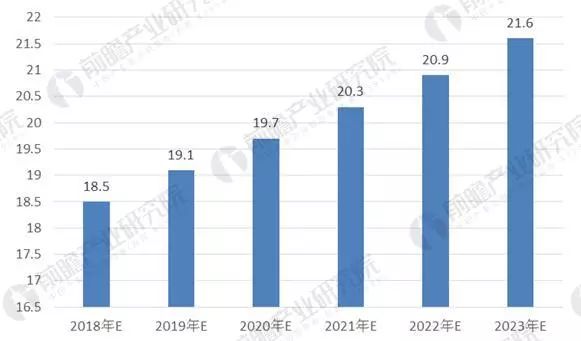

According to China's power industry development plan, and the historical development of transformers, forward-looking analysis predicts that in 2023, China's transformer output will reach 2.16 billion kVA, and the transformer manufacturing industry market is expected to reach 750 billion yuan.

Figure 8: Forecast of China's transformer production scale in 2018-2023 (unit: billion kVA)

Bus Copper Strip Machine,Interconnection Copper Strip Equipment,Photovoltaic Copper Strip Annealing Equipment,Copper Strip Corrosiveness Laboratory Equipment

Jiangsu Lanhui Intelligent Equipment Technology Co., Ltd , https://www.lanhuisolar.com